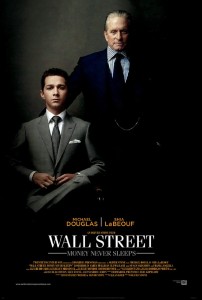

Wonder why prices for food and other commodities are higher now than they were a decade ago? Forget the rise in population to nearly 7 billion souls. Disregard the astonishing expansion of economies in China and elsewhere. No, it’s the sinister folks at Goldman Sachs who have made wheat so costly.

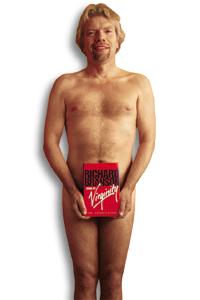

We know this thanks to Foreign Policy, published by the Slate unit of the Washington Post Co. The revelation appeared April 27, under the headline “How Goldman Sachs Created the Food Crisis.” The subhed: “Don’t blame American appetites, rising oil prices, or genetically modified crops for rising food prices. Wall Street’s at fault for the spiraling cost of food.”

I share this because I continue to be amazed at how those evil folks, speculators, keep popping up as piñatas for politicians, conspiracy theorists and the ill-informed. Even smart people believe this pap. Witness President Obama’s recent attack on speculators for boosting gas prices, a fresh assault that includes a federal investigation. Clearly, the appeal of a bogus idea can be irresistible.

In the FP piece, Frederick Kaufman argues that the Goldman Sachs Commodity Index lays at the center of a nasty web of big-money players who have cast farmers into near-irrelevancy. Even “bona fide” big players –- including corporations that buy and sell cereals for use –- have been sidelined by speculators, he tells us. The speculator –- who “neither produces nor consumes corn or soy or wheat,” and thus is evil by definition, has risen to be a menace, Kaufman suggests. Speculators now vastly outnumber the legit folks thanks to the GSCI and the popularity of investment products based on the index.

To market-watchers, these ideas may pluck familiar strings. Kaufman sang the tune in a July 2010 Harper’s cover story, making few friends at Goldman. Steve Strongin, the firm’s head of Global Investment Research, fired back at the time: “Long-term trends, including increased meat consumption by the growing middle class in the emerging markets and the increased use of biofuels in the developed markets, have created a backdrop for global food shortages and, as a result, millions are left desperately exposed to the vagaries of the weather for their survival. It is a shame that the plight of these millions appears to merit a cover story in your magazine only when it is exploited as a pretext to launch unsubstantiated attacks against the financial industry.”

As his latest effort shows, however, Kaufman remains unbowed.

“Today, bankers and traders sit at the top of the food chain – the carnivores of the system, devouring everyone and everything below,” writes Kaufman, an associate professor of English and Journalism who can turn a phrase well. “Near the bottom toils the farmer. For him, the rising price of grain should have been a windfall, but speculation has also created spikes in everything the farmer must buy to grow his grain – from seed to fertilizer to diesel fuel. At the very bottom lies the consumer.”

Further, he suggests, people across the world are starving thanks to this system. Some 250 million people joined the ranks of the hungry in 2008, bringing the total of the world’s “food insecure” to 1 billion, a number never seen before. This, it appears, is the fault of the speculative fury that followed creation of the GSCI in 1991 and, worse, deregulation of futures in 1999. Prices have soared thanks to the rush of money, including a lot of dumb money, in the markets.

Finally, the author argues that the evil geniuses at Goldman Sachs rigged the game by devising the index as a long-only product. “Every time the due date of a long-only commodity index futures contract neared, bankers were required to ‘roll’ their multi-billion dollar backlog of buy orders over into the next futures contract, two or three months down the line,” he says. Evidently, none could ever cash out their stakes, a notion that may surprise those who have done so.

Kaufman offers a few nuggets of data — sort of — to buttress his argument. Mainly, he zeroes in on 2008 when commodities were lofted in a short-lived bubble. Hard spring wheat, usually $4-$6 a bushel, topped $25 at one point, he says. And he notes that the worldwide price of food rose 80% from 2005 to 2008 and has kept rising, though he doesn’t say what is being measured as food or who is doing the measuring.

But all that is beside the point. Kaufman omits the inconvenient truth that in the last decade prices have fallen, as well as risen, in commodities and commodity-linked investments. The iShares S&P GSCI Commodity-Index Trust jumped from about $50 a share in July 2006 to above $76 in June 2008, but plunged below $23 by February 2009 before clawing its way back to about $40 now. The wheat he refers to now fetches about $9 a bushel at the Minneapolis Grain Exchange, a far cry from $25. Long only or not, investors have made or lost money as prices roller-coastered. This escalator doesn’t have only an up button.

Certainly it’s possible that the surge of money into commodity-related products has made pricing more volatile. The growth of buyers and sellers in any market might do that. But, could they force an unbroken upward climb detached from basic supply and demand issues? That would ignore the global surge in demand for food and commodities. Moreover, it would be blind to drought, blight, excessive wetness at planting time and other weather-related factors — some of which figured into the February 2008 surge in wheat prices. Blame the billions of hungry folks out there, not Wall Street’s thousands.

Of course, Kaufman’s logical flaws don’t end there. His fingering Goldman’s index as the root of evil, especially because of its long-only nature, is at best silly. Plenty of other vehicles for commodity investing beckon. “Just because you cannot short through this fund does not mean that you cannot short elsewhere nor that you cannot sell your shares once you think prices have peaked,” says Craig R. MacPhee, an economist at the University of Nebraska-Lincoln who specializes in global development and trade. “There may be speculative buying that drives up prices at least temporarily, but I doubt that the GSCI has anything to do with it.”

Goldman isn’t taking Kaufman’s broadside laying down. Managing director Lucas Van Praag in a May 3 rebuttal argues that the writer “does not present any credible evidence that commodity index investing is responsible for the rise in food prices. Serious inquires, such as one conducted by the OECD in the wake of the 2008 price spike, have concluded that ‘index funds did not cause a bubble in commodity futures prices.’ Rather than destabilizing futures markets, commodity index funds provide them with a stable pool of capital, improving farmers’ ability to insure themselves against the risks inherent in agricultural prices. This, in turn, can allow farmers to produce more food at a lower cost.”

Goldman isn’t taking Kaufman’s broadside laying down. Managing director Lucas Van Praag in a May 3 rebuttal argues that the writer “does not present any credible evidence that commodity index investing is responsible for the rise in food prices. Serious inquires, such as one conducted by the OECD in the wake of the 2008 price spike, have concluded that ‘index funds did not cause a bubble in commodity futures prices.’ Rather than destabilizing futures markets, commodity index funds provide them with a stable pool of capital, improving farmers’ ability to insure themselves against the risks inherent in agricultural prices. This, in turn, can allow farmers to produce more food at a lower cost.”

And, by the way, Goldman has not owned its index since 2007, when S&P acquired it. Goldman’s folks noted this in 2010 and reiterated it again in the rebuttal.

Regrettably, facts sometimes do get in the way of a good story. And suspicion of the futures markets may be inevitable. Farmers have cast a wary eye on Chicago sharpies for decades, resenting them for seemingly setting prices growers had to settle for. Never mind the underlying supply and demand curve or the combat among shorts and longs at the exchanges.

Today, most people don’t have a clue what goes on in these markets. Players who rely on opaque math and hunches are likely disinclined to share the secrets of their successes (or failures). And, yes, occasionally bad actors do try to game the markets. But if the folks at Goldman could pull off half the manipulation ill-informed writers suspect them of, they’d be a heck of lot richer than they already are and that’s saying something.